Deciding when to click that “apply” button on the Social Security website is perhaps the most significant financial decision a retiree will ever make. It isn’t just a paperwork exercise; it is the foundation of your retirement income floor. For those living in the Central Florida corridor—from the quiet, oak-lined streets of Winter Park to the modern, master-planned communities of Lake Nona—the stakes are high.

Social Security is often the only inflation-adjusted, government-guaranteed income stream that will last as long as you (and your spouse) are alive. In an era where corporate pensions have largely vanished, Social Security has become the “new pension.” Yet, despite its importance, it is one of the most misunderstood financial assets in America.

The question echoes through every country club and coffee shop in Windermere and Dr. Phillips: “Should I take it now at 62, wait until my Full Retirement Age, or hold out for the maximum benefit at 70?”

This guide is designed to provide the clarity needed to manage what is effectively a million-dollar asset. If you had a seven-figure brokerage account, you wouldn’t manage it with guesswork or “gut feelings.” Your Social Security benefits can easily exceed $1 million in total lifetime value for a couple; it deserves the same level of rigorous, objective analysis as part of your retirement planning.

The Three Pillars of Social Security Timing

The Social Security Administration (SSA) uses a formula designed to be “actuarially neutral.” In theory, if you live to your exact average life expectancy, you’ll receive the same total amount of money regardless of when you start. However, nobody is average. Your health, your family history, your specific tax situation, and your Orlando lifestyle are unique.

1. The Early Bird: Claiming at Age 62

For many Orlando residents, the lure of immediate cash is strong. You’ve spent decades working, perhaps commuting on I-4 or dealing with the hustle of the tourism industry, and you’re ready to start enjoying the Florida lifestyle today.

- The Pros:

- Immediate Cash Flow: You start receiving checks immediately. This can be crucial if you are forced into an early retirement due to health or downsizing, or if you simply want to “enjoy the money while you’re young.”

- Longevity Risk Hedge: If you have serious health concerns or a family history of shorter lifespans, taking the money early ensures you receive your benefits while you are physically able to use them.

- The Cons:

- Permanent Reduction: This is the biggest catch. Taking benefits at 62 results in a permanent reduction of up to 30% compared to your Full Retirement Age (FRA). This reduction stays with you for life; it does not “reset” when you hit your older years.

- Reduced COLA Impact: Because Cost of Living Adjustments (COLA) are percentage-based, starting with a smaller “base” benefit means every future annual raise is smaller in actual dollar terms.

2. The Standard: Full Retirement Age (FRA)

Your FRA is the age at which you are entitled to 100% of your Primary Insurance Amount (PIA). For anyone born in 1960 or later, that age is 67. For those born earlier, it may be 66 and a few months.

- The Pros:

- No Earnings Limit: This is the primary reason many Orlando professionals wait until FRA. Once you hit this milestone, you can earn $1 million a year at a job or business, and the SSA will not withhold a single penny of your benefit.

- Survivor Benefit Foundation: For married couples, the benefit the higher-earning spouse is receiving at the time of their death often becomes the survivor benefit for the remaining spouse. Waiting until at least FRA ensures a more stable financial floor for a surviving loved one.

- The Cons:

- The “Middle Ground” Trap: While you avoid the 30% penalty, you also miss out on the 8% annual “guaranteed” growth that comes with waiting just a few years longer.

3. The Maximum Strategy: Waiting Until Age 70

Waiting until 70 is often the “Gold Standard” for mathematical optimization, though it requires the most discipline and alternative income sources to fund the “gap years.”

- The Pros:

- Delayed Retirement Credits: For every year you wait past your FRA (up to age 70), your benefit increases by 8% per year. This is a simple interest credit that is essentially a guaranteed return on your “patience.”

- The Ultimate Inflation Hedge: By age 70, your benefit could be 76% to 77% higher than it would have been at age 62. When inflation hits—as we’ve seen recently with rising insurance and housing costs in Central Florida—having the largest possible inflation-adjusted check is the ultimate protection.

- The Cons:

- The “Breakeven” Anxiety: If you wait until 70, you are “losing” eight years of checks. It typically takes until age 80 or 82 to reach the “breakeven point”—the age where the total cumulative money received from the age 70 strategy surpasses the total money you would have had by starting at 62.

Working While Collecting—The “Orlando Earnings Trap”

Orlando is a unique hub for “active retirees.” Whether it’s a retired executive consulting for a tech firm in Lake Mary or a former teacher working part-time at one of the world-famous theme parks, many people choose to keep working well into their 60s.

If you claim Social Security before your Full Retirement Age and continue to earn an income, you must navigate the Social Security Earnings Test. This is where many DIY retirees make mistakes.

How the Limits Function (2024/2025 Benchmarks)

The SSA tracks your “earned income” (W-2 wages or net self-employment income). It does not include pensions, 401(k) withdrawals, or investment income.

- Under FRA for the entire year: If you earn more than $22,320 (2024 limit), the SSA will withhold $1 in benefits for every $2 you earn above that limit.

- The year you reach FRA: A higher limit applies (roughly $59,520). In the months leading up to your birthday, the SSA will withhold $1 for every $3 you earn above that limit.

- The Month You Hit FRA: The “handcuffs” come off. You can earn any amount, and your check is yours to keep in full.

The “Mistake” Case Study: Imagine “David,” a Maitland resident who retired from a management role but took a “fun” consulting gig earning $70,000. He claimed Social Security at 62. Because he was roughly $47,000 over the limit, the SSA withheld over $23,000 of his benefits.

Essentially, David took a permanent 30% cut to his lifetime benefit, but he didn’t even get to keep the money in the short term because his “job” was too successful. He would have been far better off waiting until his FRA to claim.

Retirement Savings Pitfalls to Avoid in Florida →

The Complex World of Spousal and Survivor Benefits

This is the area where “Standard” advice often fails. Social Security planning is not an individual sport; it is a team sport for married couples.

Spousal Benefits

Even if one spouse never worked outside the home, they may be eligible for a spousal benefit. This can be up to 50% of the higher earner’s benefit at their Full Retirement Age. However, if the lower-earning spouse claims their spousal benefit before their own FRA, that amount is also permanently reduced.

The “Survivor” Strategy

This is perhaps the most emotional and critical part of the plan. When one spouse passes away, the smaller of the two Social Security checks disappears. The surviving spouse keeps the larger of the two.

The Strategy: It often makes sense for the higher-earning spouse (regardless of gender) to delay claiming as long as possible (ideally until 70). Why? Because they are effectively “buying” a larger life insurance policy for the surviving spouse. By maximizing their check, they ensure that when one of them passes, the remaining spouse has the largest possible monthly income floor to maintain their lifestyle in Orlando.

Real-World Mistakes—Lessons from the Field

Examining the paths others have taken can provide a roadmap for what to avoid.

The “Fear of the Fund” Mistake

Many retirees claim at 62 because they read headlines about the Social Security Trust Fund “running out of money.” While it is true the trust fund faces long-term challenges, it is highly unlikely the system will simply disappear. Even in a “worst-case” scenario with no legislative changes, the system is projected to be able to pay roughly 77% to 80% of benefits.

We saw a couple in Celebration who claimed early out of fear, only to realize five years later that they were in perfect health and now regretted having a significantly smaller check for the next 30 years. Base your decision on your personal health and math, not on political headlines.

The “Sequence of Returns” Oversight

A gentleman in Winter Garden claimed Social Security at 62 because he didn’t want to “touch his investments” during a market downturn. While this seems logical, he failed to realize that by taking a permanent 30% haircut on his Social Security, he was giving up a “guaranteed” 8% annual return he would have received by waiting.

Sometimes, it is mathematically superior to spend a portion of your portfolio to “bridge the gap” to age 70, effectively “buying” a higher, inflation-protected income stream from the government.

The Florida Tax Advantage (and the Federal Reality)

Living in the “Sunshine State” offers a massive advantage for retirees: Florida has no state income tax. Many states (like Colorado or Connecticut) tax a portion of Social Security. Here in Orlando, your state tax bill on Social Security is $0.

However, the federal government still wants its share. This is determined by your “Combined Income.”

The Combined Income Formula:

$$Combined Income = Adjusted Gross Income (AGI) + Tax-Exempt Interest + 50\% of Social Security Benefits$$

- If you are Married Filing Jointly:

- $32,000 – $44,000: Up to 50% of your benefits may be taxable.

- Over $44,000: Up to 85% of your benefits may be taxable.

This creates a “Tax Torpedo” where an extra dollar of IRA withdrawals can suddenly make more of your Social Security taxable, effectively leading to a much higher marginal tax rate than you anticipated. Proper planning involves coordinating your 401(k) withdrawals and Roth conversions to keep this “Combined Income” number as low as possible.

Why “DIY” Planning Often Falls Short

When you visit a local Social Security office such as the one on West Colonial Drive; the staff are government employees trained to process paperwork. They are not financial advisors. They are legally prohibited from giving you “advice” on which strategy is best for your specific family.

They generally cannot help you analyze:

- Portfolio Longevity: How does claiming at 62 versus 70 affect the probability of your portfolio lasting until age 95?

- The Tax Interplay: How does your Social Security timing impact the required minimum distributions (RMDs) you’ll have to take from your IRA later in life?

- Health-Adjusted Breakeven: A “standard” breakeven analysis uses age 80. But if you have specific health data, that breakeven point might move to 75 or 85.

- Inflation’s Compound Effect: Over 30 years, the difference between a 3% COLA on a $2,000 check versus a $3,500 check is hundreds of thousands of dollars.

Social Security is one piece of a much larger puzzle. If you get the timing wrong, you have a very narrow window to fix it. You have exactly 12 months after claiming to change your mind, but you must pay back every dollar you received in full; a hurdle that is financially impossible for most people once the money has been spent.

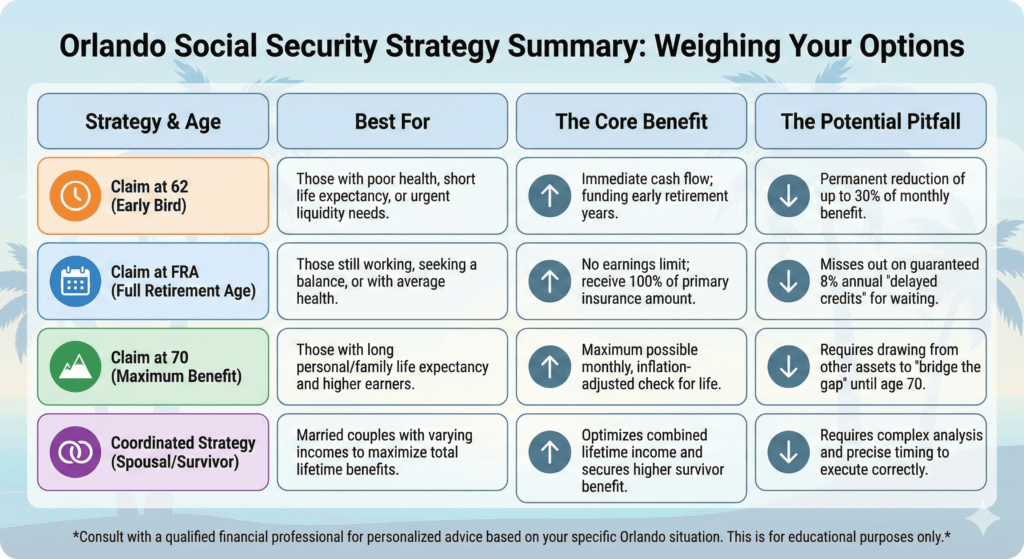

Social Security Strategy Summary Strategy Table

Designing Your Social Security Roadmap

In the end, Social Security isn’t just about a monthly check; it’s about longevity insurance. It’s about ensuring that if you live to be 100 in your beautiful home in Central Florida, you never have to worry about outliving your income.

The “right” age to take Social Security is rarely a single, obvious number. It is a decision that must be weighed against your total financial picture: your home equity, your retirement accounts, your health, and your legacy goals.

The most successful retirees in Orlando are those who move from guessing to knowing. They look at the data, understand the tax implications of the federal government, and build a plan that allows for security in every stage of life. Before you sign that government form, ensure you’ve looked at the “what-ifs.” In a world of uncertainty, Social Security optimization is one of the few areas where you can truly take control of your financial destiny.

Resources & Educational Tools

- SSA Publication No. 05-10069: How Work Affects Your Benefits: A detailed PDF guide explaining the earnings test and how your benefits are recalculated once you reach Full Retirement Age.

- IRS Publication 915: Social Security and Equivalent Railroad Retirement Benefits: The definitive guide on how the federal government taxes your benefits and how to calculate your “combined income.”

- Medicare.gov: Remember that for many retirees, Social Security and Medicare go hand-in-hand. Even if you delay Social Security until 70, you typically need to sign up for Medicare at 65 to avoid permanent late-enrollment penalties.